How to trade oil in the face of rising energy prices

Paul Roberts

13 / March / 22

Visitors: 665

Paul Roberts

13 / March / 22

Visitors: 665

Supply-side constraints in energy markets have seen commodities such as natural gas and wheat hit new all-time highs, while oil prices approached all-time highs not seen since the 2008 financial crisis.

In this article, we will look at how to trade oil in the face of rising energy prices. You can use this trading idea as the basis for creating your own.

Why is it worth trading oil now?

Analysts at investment banks such as JP Morgan predict that oil could reach $185 a barrel if countries continue to restrict supplies from Russia. Since the beginning of this month, oil prices have risen more than 35% to just over $130 a barrel.

Russia is one of the largest oil producers in the world with a market share of 12%. Nearly half of all Russian oil goes to Europe, with China being the largest importer of Russian oil. So far, countries like Germany have been reluctant to ban energy exports from Russia.

However, governments are looking for ways to completely phase out Russian oil this year, and US President Joe Biden is counting on oil from Venezuela and Saudi Arabia. This situation is likely to boost oil prices as US Secretary of State Anthony Blinken said they are considering a ban on Russian oil and gas imports.

Do not forget that energy markets are extremely volatile in the current environment. This is good news for traders as there are likely to be more price fluctuations. However, proper risk management practices are very important in an environment of high volatility. Admirals offer a range of volatility protection tools.

Crude oil prices move to all-time highs

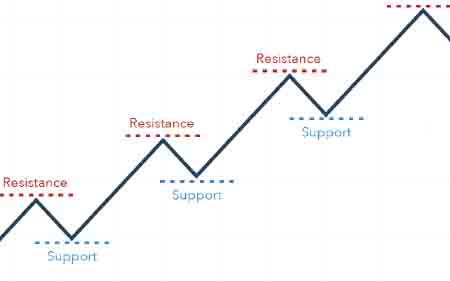

On the long-term monthly chart of WTI (West Texas Intermediate) crude oil, it is clear that the price of oil is approaching the all-time high level recorded in July 2008. Buyers still control the market and the average market price is moving up. There are many different technical analysis tools that traders can use to make trading decisions.

An example of a CFD trading idea on WTI Crude Oil

Based on the above analysis, an example trade idea for WTI Crude Oil CFD could be as follows:

- Open a buy position on the breakout of the last swing high at 131.50.

- Set stop loss at the last swing low at 106.50.

- Set a target at 156.50 when the reward to risk ratio is 1:1.

- Keep the level of risk low - no more than 2% of the total account.

- Period = 1-2 weeks

- If you are trading a 0.1 lot position, then:

- If target reached = $250.00 profit

- If Stop Loss Hit = $250.00 Loss

It is important to remember that the price of gold is unlikely to rise in a straight line; it may even drop much lower before starting to rise, especially given the volatility in the markets at the moment.

Therefore, always follow a risk management strategy - one of the most important aspects of successful trading. You should always be aware of how much loss a trade can bring, as well as the risks associated with it.

Another factor to consider is the cost of trading CFDs:

- Spread. This is the difference between the buy price and the sell price of an instrument.

- A typical WTI Crude Oil spread in Admirals is only 0.03 pips.

- Commission. This is the cost of making a transaction to buy and sell.

- There is NO commission for buying or selling CFDs on commodities on the Trade.MT4 account with Admirals.

- Swaps. This is the fee for rolling over an open position to the next trading day.

- The current swap for WTI Crude Oil CFD on Trade.MT4 account is 0.00775 for long positions and -0.03553 for short positions.

Do you have a different opinion regarding the movement of oil?

Remember that analytics and trading ideas are based on the personal opinion and experience of the author.

If you think that the oil price is more likely to fall, you can also trade short positions in your trading account thanks to CFD (Contract for Difference). This means that you can trade both long and short positions, potentially profiting from both rising and falling stock prices.

Other Ways to Trade Oil

Another way to trade on a possible rise in oil prices is to trade stocks. Oil companies involved in the extraction, refining and distribution of oil are likely to benefit from rising oil prices. However, oil stocks are also extremely volatile in the current environment, so be sure to apply a risk management strategy.

Just last week, legendary investor Warren Buffett announced a $4.5 billion stake in energy company Occidental Petroleum. Its share price has already risen this year by 70%.

We have compiled a complete Bad Reputation Brokers.

Paul Roberts

Paul Roberts 51 years old Born in Edinburgh. Married. Studied at University of Oxford, Department of Public Policy and Social Work. Graduated in 1997. Works at Standard Life Aberdeen plc.