Regulated markets are the world's major stock exchanges

Paul Roberts

17 / May / 22

Visitors: 698

Paul Roberts

17 / May / 22

Visitors: 698

Share options are generally available on electronic trading platforms operated by market companies and available to individuals through a traditional financial intermediary (broker, bank, etc.).

French investors can find options on around sixty different stocks on the Euronext derivatives market.

Regulated markets

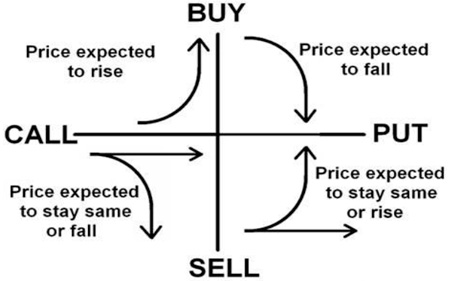

Historically regulated markets such as Euronext are the world's major stock exchanges: they offer a wide range of stock options (call and put) for listing at different exercise prices and maturities.

In these markets, the investor can follow the change in the value of options during the day using the built-in screen and know the amount of compensation set at the end of the day.

He can close the option position at any time by reselling (purchasing) his option on the market before it expires. In addition to this constant “turnover” of contracts, trading on a regulated market has two important advantages:

The exchange ensures the correct execution of the order and checks that the procedure is carried out in accordance with the rules

Investors are guaranteed the proper outcome of transactions due to the existence of a clearing house, and the market benefits from a financial security mechanism for transactions: quilts .

The services provided by the clearing house are paid for by the so-called clearing commission, which the intermediary passes on to its clients.

OTC Markets

Financial institutions may also offer, individually or jointly through a specialized subsidiary, over-the-counter option listing services, access to which is most often restricted to their clients.

It also allows you to make more customized decisions and offer sometimes more complex products such as barrier options or average options. But because sellers are not required to make a margin deposit, OTC markets do not enjoy the same financial protection as regulated markets.

Who should I contact?

Speak first to a specialized intermediary who will provide you with useful tips and skills to trade options on the best terms. This could be a bank (not all offer options), an investment company (former brokerage firm), or an online brokerage mostly accessed via the Internet.

In order to facilitate the search for a dedicated intermediary for retail investors wishing to operate in these derivatives markets, Euronext has partnered with financial intermediaries who have this expertise and are committed to providing quality service to their clients. You will find the list on the Euronext website.

In any case, look for an intermediary with favorable rates for an investor profile like yours. This is especially true if you have modest amounts to spend on options, as you will sometimes be asked for a flat fee that penalizes orders associated with small amounts. Compare!

Commissions. Negotiation and clearing fees must be paid in addition to the transaction fees charged by your financial intermediary.

Place the correct order

To buy or sell options, you send an exchange order to your financial intermediary. If he is a market trader (i.e. authorized by the exchange to trade directly on the market), he will take care of the execution of your order; if he is a simple "order picker", then he will entrust the execution to the trader.

When placing an exchange order, you must specify a number of details that are the first guarantee of proper execution.

Once submitted to your intermediary, your order is immediately sent to the trading organization, which presents it on a regulated (or authorized) market where securities are traded. When your order is completed, you will receive a “transaction notice” from your reseller, which contains all the information regarding the fulfillment of your order: please read it carefully and keep it.

The institution where your account is located is responsible for debiting the amount due and adding new options to your portfolio if you are a buyer or crediting your account if you are a seller. Note that options lead to a separate account from the securities account that you can hold for shares.

We have compiled a complete Bad Reputation Brokers.

Paul Roberts

Paul Roberts 51 years old Born in Edinburgh. Married. Studied at University of Oxford, Department of Public Policy and Social Work. Graduated in 1997. Works at Standard Life Aberdeen plc.