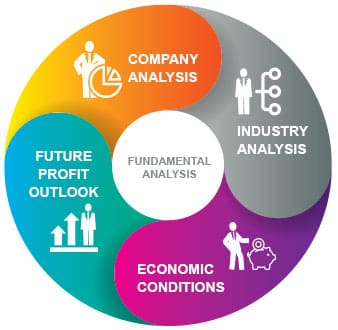

Learn more about the fundamental analysis process and its impact on investments

Paul Roberts

07 / April / 22

Visitors: 670

Paul Roberts

07 / April / 22

Visitors: 670

The central question of this analysis is: what is the business model, how does the respective company make money, is it profitable in the long run? “Investors who don't understand the business model should keep their hands off the company's shares,” says Franz-Josef Löfven, deputy managing director of the Deutsches Aktieninstitut in Frankfurt am Main.

In addition to the business model, investors look to various key fundamental analysis metrics.

These include, for example:

- Profitability: Analysts are looking at how earnings have risen in recent financial years.

- Price to Earnings Ratio (P/E): Analysts relate earnings per share to the current share price. The price is divided by earnings per share. The result is a price/earnings ratio (P/E) that investors can now compare with other companies in the industry. “However, there are some elusive things that come up when determining the price/earnings ratio,” Levene says. So the course can change quickly. And profits usually fluctuate. “It's always about expected returns,” Levene adds.

- Price-Cash Flow Ratio (KCV): Cash flow measures how large a company's freely available cash flows are. Here, the analyst sets the cash flow per share in relation to the share price. “P/E and P/E are important in determining whether a stock is undervalued or overvalued,” Levene explains. It can be profitable for an investor if the company's P/E or KCV is lower than that of a competitor.

- For example, suppose an investor is considering buying shares in a company, and suppose that the KCV of those shares is 20. If the KCV of one competitor's shares is 23.99 and another competitor's is 25.33, then buying the company's shares can be cheap. originally chosen company.

- But be careful: KCV is just one of several key figures that investors should consider. In addition, key indicators are snapshots. “Things can look completely different the next day,” Levene says.

- Dividend yield: A company's dividend, i.e. the annual share of net income per share, is an important signal to an investor: are dividends paid at all? How tall is it. Is it stable, growing or fluctuating? Dividend yield is the comparison of a dividend with the current share price. This is calculated as the dividend multiplied by 100 divided by the share price. This gives a dividend yield.

- Example: A company distributes a nominal dividend of €3.50, the current share price is €66. The dividend yield here is 5.3 percent. Here you can find information about the dividend yield of DAX companies in 2020.

- Equity ratio: This key metric can—but doesn't have to—indicate how resilient a company is to crises. The higher the equity, the better the company will be able to survive economic crises. An analogue of the equity ratio is the debt capital ratio, which summarizes the level of debt in numbers. With a low equity ratio and a high debt ratio, there is a high risk that a financially distressed company will not be able to meet its debt burden and, in the worst case, be forced into bankruptcy.

We have compiled a complete Bad Reputation Brokers.

Paul Roberts

Paul Roberts 51 years old Born in Edinburgh. Married. Studied at University of Oxford, Department of Public Policy and Social Work. Graduated in 1997. Works at Standard Life Aberdeen plc.